The Reference-Based Pricing (RBP) approach can result in significant plan savings - up to 30% or more.

RBP uses the baseline set by the government (Medicare) as reasonable and customary medical charges and pays 30%-50% above that price. Typical PPO networks pay 100%-500% above Medicare.

Savings accrue to the sponsor of the Limited Liability plan because 150% of Medicare reimbursement is typically far less than what is allowed by the commercial PPO networks. In addition, medical stop loss premium rates should be lower under an RBP plan because the lower level of allowed charges reduces the level of the insurance carrier.

*Example:

Major Joint Replacement

Charged by provider = $29,240.00

Medicare Payment = $11,576.00

Typical PPO Payment = $23,152

RBP Payment = $17,364

Being in a RBP plan could have saved your company $5,788.00 off the claim amount.

*CMS Database 2013, Northern Virginia

Employer plan sponsors retain all the traditional advantages of limited liability group medical plans including the ability to avoid state insurance mandates and state premium taxes, while retaining the ability to offer identical plan designs to employees who reside in different states.

When a company uses an RBP plan, the PPO network arrangement is removed from the health plan for hospitals and facility access. This means that plan participants are no longer limited to a set network of hospitals, but rather are permitted to choose any qualified facility. In conjunction, a network is still utilized for physician access, meaning providers such as family doctors do not see a change. The health plan simply reimburses claims on a set fee schedule.

SVG has the relationships in place to enable its clients to realize their full potential in health care savings.

Why has health care cost risen at such an alarming rate?

Time Magazine: Bitter Pill by Stephen Brill (Video Part 1)

Time Magazine: Bitter Pill by Stephen Brill (Video Part 2)

Bitter Pill: Why Medical Bills Are Killing Us (Full Article)

What can an employer do?

Medicare Plus Repricing – Not For The Faint Of Heart

Beating Medical Trend – Managed Care vs Reference Based Pricing

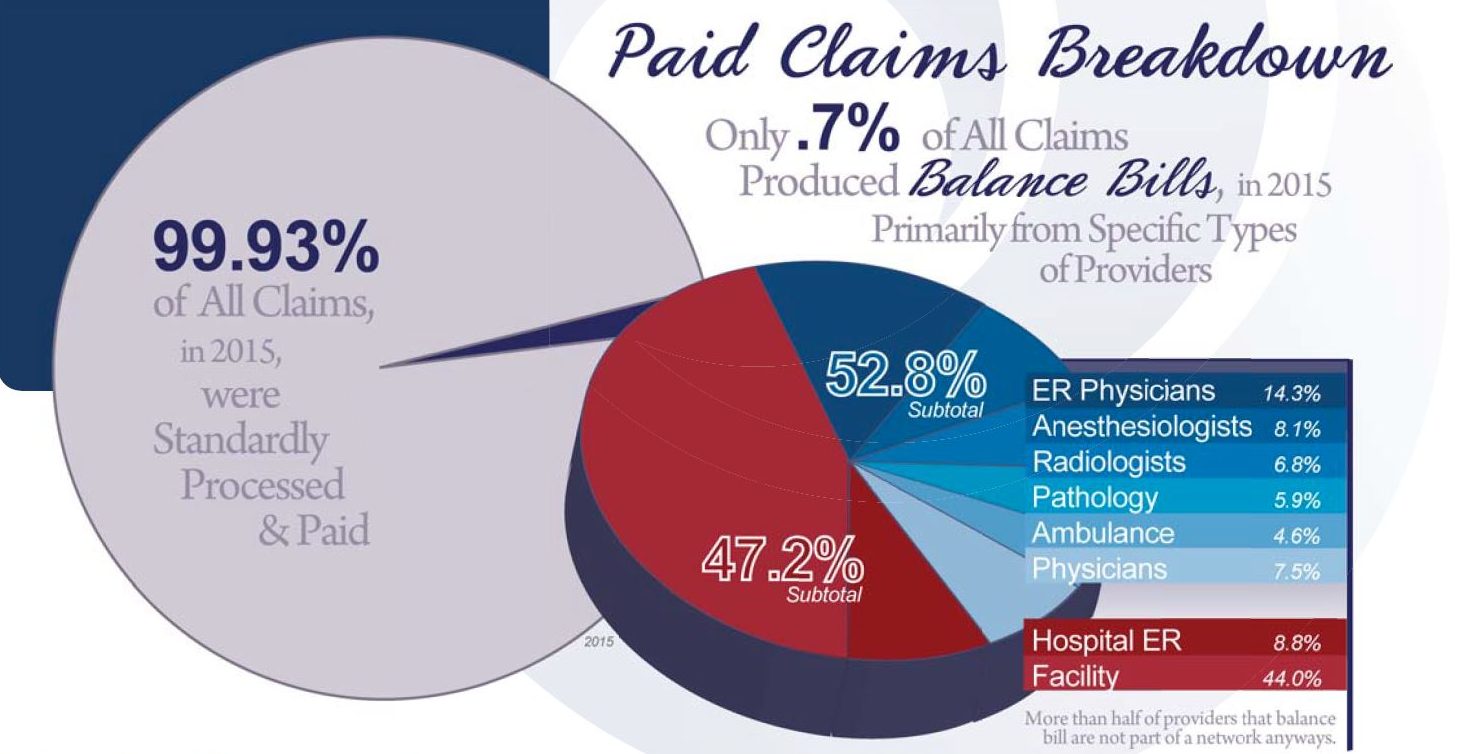

Balanced Billing

Balanced Billing Is the Ugly Beast of Medical Insurance

State Restriction Against Providers Balance Billing Managed Care Enrollees

Balance Billing: How Are States Protecting Consumers from Unexpected Charges?

PHCS.com – Find network providers that are in your local area.

Risk Managers Blog – Excellent Resource for continued updates and information in health care industry.

In The News

Risk Managers

No feed items found.