An employer that fully understands the health care market can take advantage of its savings.

An employee that fully understands their health care plan can make the right choices.

Is Self-Funded Health Insurance Right For Your Company?

It’s a common misconception that self-funded health insurance plans are only for large employers. In fact, self-funded plans can be a great option for smaller employers, offering savings, transparency and benefit cost controls. Stop-loss insurance allows smaller employers to consider this economical approach by offering a shield against large claims, while offering the best benefit options to employees.

You can easily discover if your organization can benefit from self-funding by analyzing your existing plan design and recent claims experience. SVG provides this analysis at no cost or obligation. Isn’t it time you learned more about self-funding? Let us help.

Fully‐Insured Plans:

- Premium exchanged for coverage

- State mandated benefits usually included

- Often pre ‐determined plan design options

- Limited reporting

- Vendors are usually controlled by the carrier

- Pooled Risk

Self ‐Insured Plans:

- Pay as you go coverage

- Customized plan design

- Cash flow advantage/reserves

- Limitless reporting

- Vendor management/Best in Class partners

- Unbundled approach

Creating Your Self-Funded Plan

The flexibility of self-funding helps employers use their health benefit plans the way they were originally intended – to attract and retain the finest employees in the industry. Benefits can be customized to meet employee needs and to satisfy company objectives. SVG can help you design your self-funded plan and handle day-to-day plan administration.

At SVG, we offer a range of self-funded plan design options:

- Basic Preferred Provider Option plan structure

- Point-of-Service option, where personal care physicians help covered persons manage their care

- Exclusive Provider Option, which maximizes in-network utilization.

Our self-funded plans include access to a multitude of health networks, offering convenient access to care.

Consumer-directed health plan options are also compatible with self-funded plans. For example, we can pair a high-deductible, self-funded health plan with a Health Savings Account or a Health Reimbursement Arrangement.

Capping Catastrophic Claim Risks

Self-funded plans can sound risky, but keep in mind that an employer typically does not assume 100% of the risk for catastrophic claims. Rather, the employer buys a form of insurance known as stop-loss or excess-loss insurance, which provides reimbursements to the employer for claims that exceed a predetermined level.

This coverage can be purchased to cover catastrophic claims on one covered person (specific coverage) or to cover claims that significantly exceed the expected level for the group of covered persons (aggregate coverage).

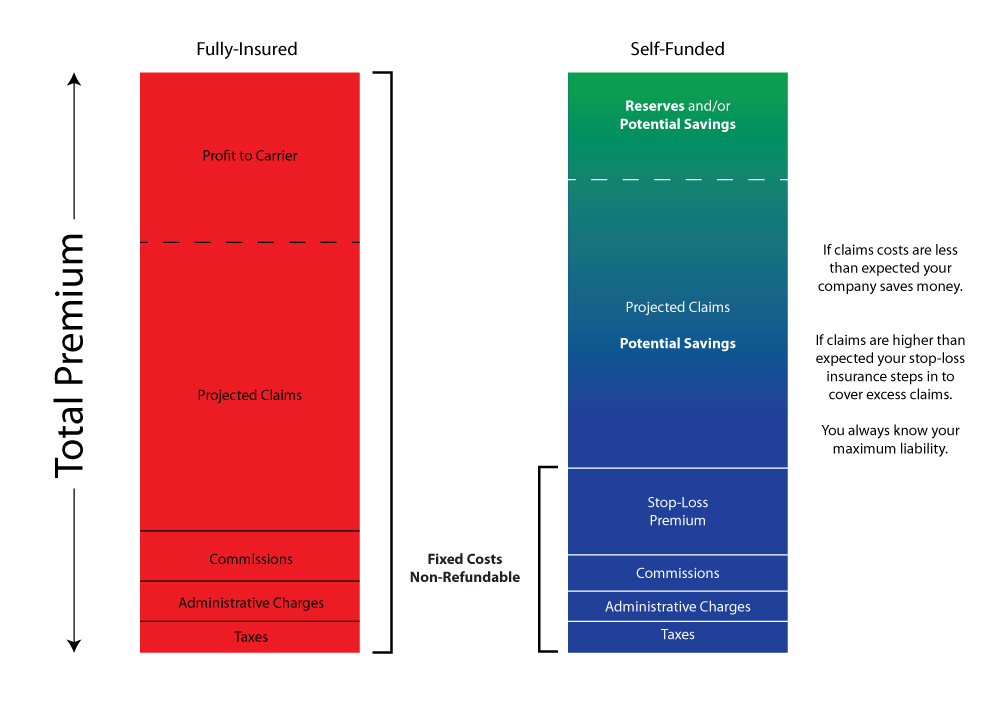

The cost of a self-funded plan includes fixed components that are similar to an insurance premium. For example, there are administration fees, stop-loss premiums, and variable costs like claims expenses. These fees and costs are charged per employee and are billed monthly based on plan enrollment, just like an insurance premium. The employer sponsoring a self-funded plan also pays the claims costs incurred by the covered persons enrolled in the plan, and this cost varies from month to month based on health care use by the covered persons. Stop-loss insurance reimbursements are made if the claims costs exceed the catastrophic claims levels in the policy.

Here’s a simple equation: Total Cost of a Self-Funded plan = Fixed Costs + Claims Expenses - Any Stop-Loss Reimbursements.

Traditional Self-Funding

Two-thirds of employees in the U.S. who are covered under an employer-sponsored health plan are covered by some form of self-funded health plan. The following are just a few reasons why employers select self-funding:

Increased Financial Control

Most employers with self-funded plans fund claims as they come due, rather than funding them through advance premium payments. That means that you are investing your own money instead of allowing an insurance company to make investments for you. At SVG, we provide you with clear reports and documentation that show how every dollar is spent, allowing you to understand your costs and how to control them.

Benefits of Self-Funded Plans

Lower Costs

By funding claims directly, an employer avoids the costs of claim reserves, retention to cover the insurance company’s administrative costs, profit margin, risk charges, premium taxes, and a contingency margin, which are included in an insured premium on top of the costs of expected claims. Today, these reserves and retention charges can range from 10% to 30%.

Greater Flexibility

Self-funding allows employers to design a health benefit plan to address specific employee needs, as well as company objectives. Self-funded plans are also exempt from state insurance laws that typically mandate certain benefits for insured plans.

Cost Management

Plan design flexibility and on-going analysis of plan expenses allow self-funded employers to make the plan design changes needed to manage costs. Self-funded plan designs can include strategies to monitor utilization, steer care to discounted provider arrangements, and assure appropriateness of care, all of which encourage wellness and provide incentives for wise utilization of care.

Information Management

A Third Party Administrator (TPA) provides convenient, secure access to all the information needed to manage a self-funded plan effectively. Authorized individuals of a self-funded employer receive confidential monthly reports, and everyone covered under the plan has secure online access to timely benefit-related information.

Sound like an option that may be right for your company? Give us a call and we can walk through how to set up your self-funded plan.